20 Feb The State of Social Ad Spend 2020

This blog post was updated in June of 2020 to reflect the most recent data in regards to social media ad spending.

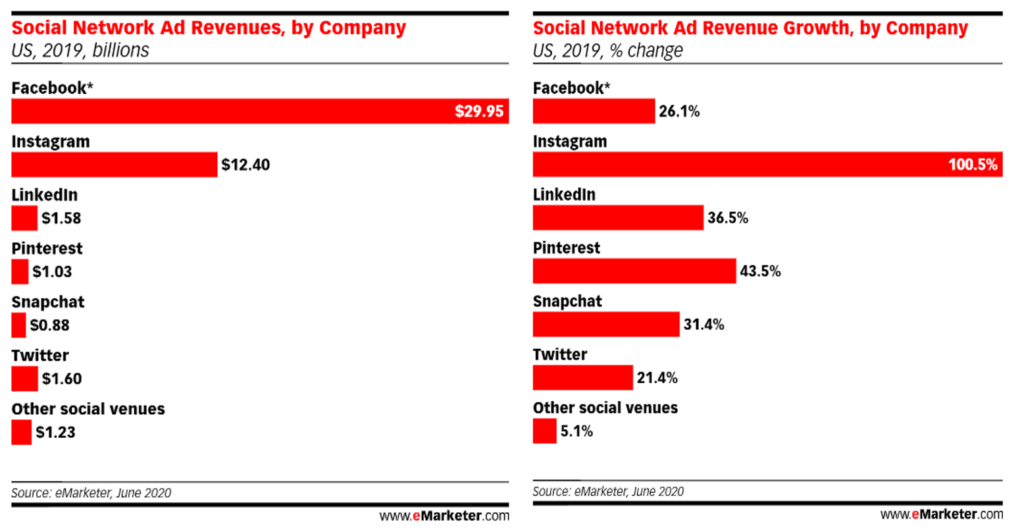

When it comes down to ad revenue, 2020 seems like a pretty good year for the major social media platforms. Facebook/Instagram took the biggest share racking up nearly $40 billion (yes, billion with a B) and about 87% of the total, followed by LinkedIn at $1.58 billion and then Pinterest at $1.03 billion. Let’s break down the state of social ad spend.

State of Social Ad Spend Growth

While Facebook alone had the most revenue overall, Instagram had the highest growth at 100.5%. Pinterest also saw high growth at 43% followed closely by LinkedIn at 36%. Of the networks mentioned, Twitter had the least amount of growth at 21.4%.

There are so many ways to think about the investment in paid social with respect to what it provides to brands. That answer depends, in most part, on what the dollars were intended to do. We do see some clear trends over time related to its performance that impact the bottom line.

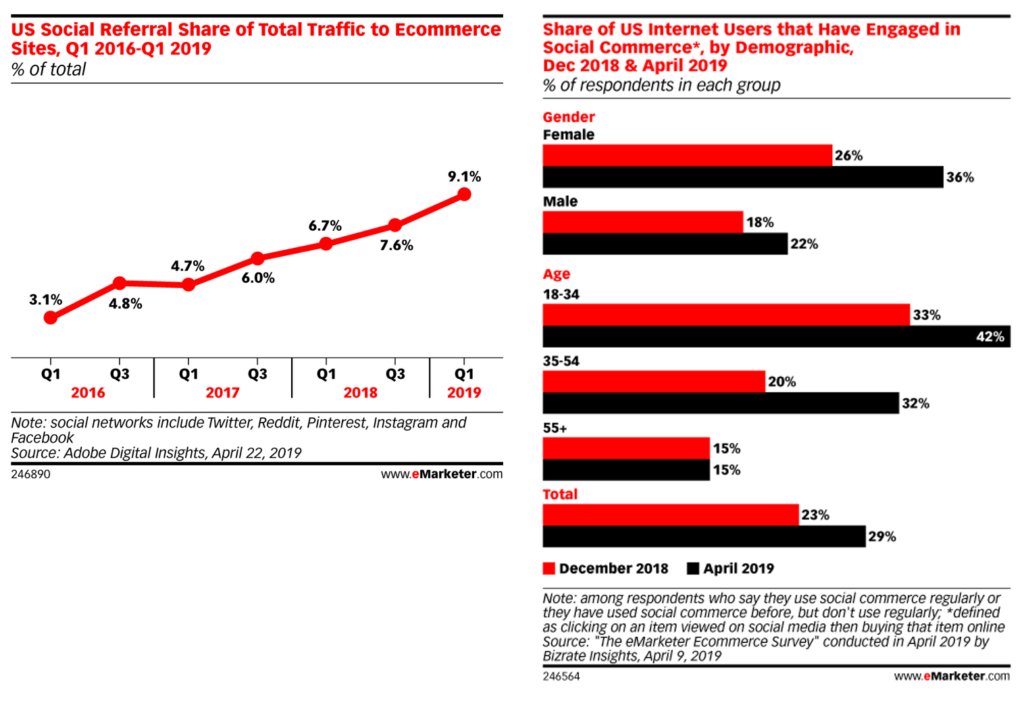

For starters, eCommerce sites are seeing year-over-year increases in referrals from social. What was a notable spec at about 3% in Q1 of 2016 has moved to an impressive share at 9% in Q1 of 2019. This data doesn’t specifically call out paid but since organic social reach has declined over the years, paid social likely has a role in some capacity.

Ad Spend & Social Commerce

In addition to referrals from social, Internet Users are engaging more in social commerce. This, social commerce, is defined as clicking an item viewed on social media and then buying that item online. There are increases from December 2018 to April 2019 with both males and females as well as across most age segments. Collectively, the increase was 6%; going from 23% to 29%. So, it’s important to be sure there is share of brand voice on social because users are increasingly taking that viewing experience and translating into dollars for brands.

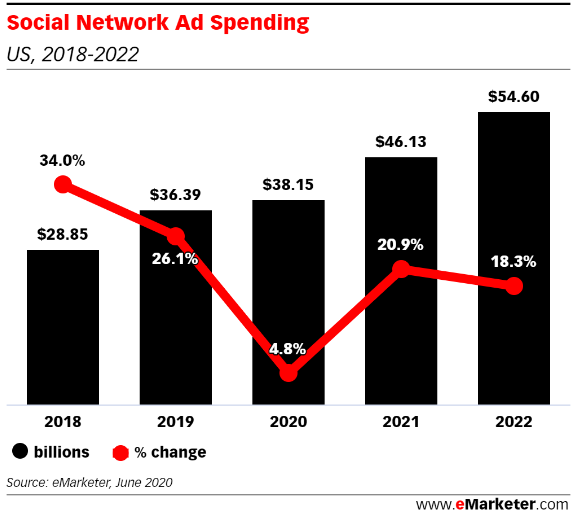

The recent Covid-19 pandemic has greatly impacted ad budgets during the first half of 2020 and will continue to do so for the remainder of the year. Despite the growth rate slowing in 2019, social network ad spending was expected to see a 20.4% increase prior to the pandemic. Now, due to many advertisers pausing or adjusting budgets updated projections show a dramatic drop in 2020 social network ad spend. Recent updates estimate 2020 ad spend at 4.8%, a 15.6% drop from pre-pandemic projections. But don’t be discouraged, budgets are expected to bounce back. By 2021, social network ad spending will be close to $57 billion, which nearly double that of 2017.

For even more information in the social space for 2020, please read this post. Have additional questions about your budgets or ad spend? Contact us using the form below!